Three years have passed since the European Commission published a legislative proposal for mandatory tax transparency for multinational companies in the EU, called Public Country by Country Reporting[1]. This week, Ministers from EU Member States will discuss the proposal for the first time at the Competitiveness Council meeting of the EU. Transparency International, Eurodad, Oxfam and ActionAid are calling on Member States to demonstrate their commitment to transparency and adopt an ambitious agreement at the meeting and finally end the deadlock.

Globally, corporate tax avoidance costs countries an estimated US$500 billion each year. In the EU, the annual loss due to profit shifting by multinational corporations is conservatively estimated to be €50-70 billion[2] and developing countries also lose at least $100bn a year[3] in tax revenue. Big companies are also are paying less tax than they did before the 2008 financial crisis [4]. These lost funds could go towards services that are of critical importance to citizens, such as education and healthcare.

Despite the enormity of these losses and the significant impacts on the revenues available to our governments and citizens, some Member States have been blocking this crucial piece of legislation to end tax secrecy and, consequently, have made it easier for big companies to hide what they are paying in tax. Reports name these countries as Austria, Cyprus, Czech Republic, Estonia, Germany, Hungary, Ireland, Latvia, Luxembourg, Malta, Slovenia and Sweden[5].

Leaks and tax scandals, such as Luxleaks and the Paradise Papers have highlighted the secrecy of the current system and have demonstrated that large multinationals are still able to hide financial and tax-related information[6].

This week is the first time the EU proposal will be discussed at a political, rather than technical, level thanks to the efforts of the Finnish Presidency. If an agreement is reached, formal negotiations between the European Commission, the European Parliament and the Council of the EU would finally begin.

The ultimate aim of the legislation is greater transparency – enabling citizens, journalists, and civil society to see how much companies pay in taxes, and where. This would also help to ensure that taxes are fairly paid in the countries where they are due (where real economic activity takes place) and provide revenue for critical public services – within and outside the EU.

We call on the Member States blocking the legislation to put the interests of citizens and the public services they rely on first, and work together to arrive at an ambitious position in support of public Country by Country Reporting.

END

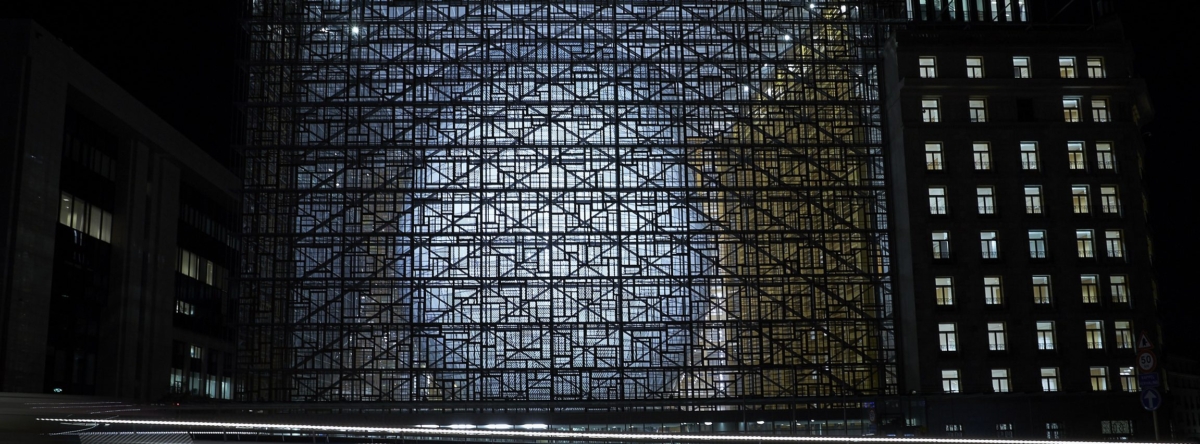

***Photo call on Thursday 28 November at 8:30am at Schuman: Civil society organisations will hold a public action outside the Council of EU Member States***

Notes to editor

[1] Proposal for a Directive of the European Parliament and of the Council amending Directive 2013/34/EU as regards disclosure of income tax information by certain undertakings and branches.

The European Commission initially proposed this draft Directive in 2016, however it has been in deadlock ever since. This deadlock is mainly due to the legal basis of the file. Some Member States would prefer to legislation to be treated as a tax file, and therefore a national competency, instead of an accounting file, which is the current classification. This would have serious implications in the process, as in the case of a tax file the European Parliament would only have an opinion-giving role and a unanimity vote (as opposed to a qualified majority vote) in the Council would be required.

The European Parliament voted on the file in July 2017 and closed its first reading in March 2019.

Companies in the financial and extractives sectors are already required to publish key financial data and tax payments on a country by country basis, according to the Capital Requirement Directive IV and Chapter 10 of the Accounting Directive, both adopted in 2013.

[2] Cobham, Alex, and Janský, Petr, Global Distribution of Revenue Loss From Tax Avoidance: Re-Estimation And Country Results, WIDER Working Paper 2017/55 Helsinki: UNU-WIDER, 2017 available from https://www.wider.unu.edu/sites/default/files/wp2017-55.pdf

[3] European Parliament Research Service, Bringing transparency, coordination and convergence to corporate tax policies in the European Union. I – Assessment of the magnitude of aggressive corporate tax planning, September 2015, available from http://www.europarl.europa.eu/RegData/etudes/STUD/2015/558773/EPRS_STU(2015)558773_EN.pdf

[4] UNCTAD (2015). World Investment Report 2015: Reforming International Investment Governance. https://unctad.org/en/PublicationsLibrary/wir2015_en.pdf

[5] Financial Times (2018) Multinationals pay lower taxes than a decade ago https://www.ft.com/content/2b356956-17fc-11e8-9376-4a6390addb44

[6] More Transparency to Fight Tax Avoidance, The Greens/EFA in the European Parliament, https://www.greens-efa.eu/en/cbcr/

[7] For more information on one of the cases exposed in the Paradise Papers, see Transparency International EU’s blog: ‘Just hide it? Nike’s tax avoidance exposed in the Paradise Papers’